It was a lovely weekend, which must mean…

yep, its Monday again. I made a pact with man-go-round yesterday, though. Instead of the usual “countdown to friday” that tends to seep into my subconscious increasingly until that sweet TGIF moment, we decided to embrace every day for the wonderful things in it, not wishing away a single awful Monday or Wednesday moment. (Well, maybe a moment, but not MANY moments…)

So, for this week’s list, I’ve decided to provide a fun reward for every “big girl task” I complete. As many things to look forward to as to cross off.

Now that I’m 27 its time to grow up list:

- First: face the music and pay off every last hospital bill from last fall

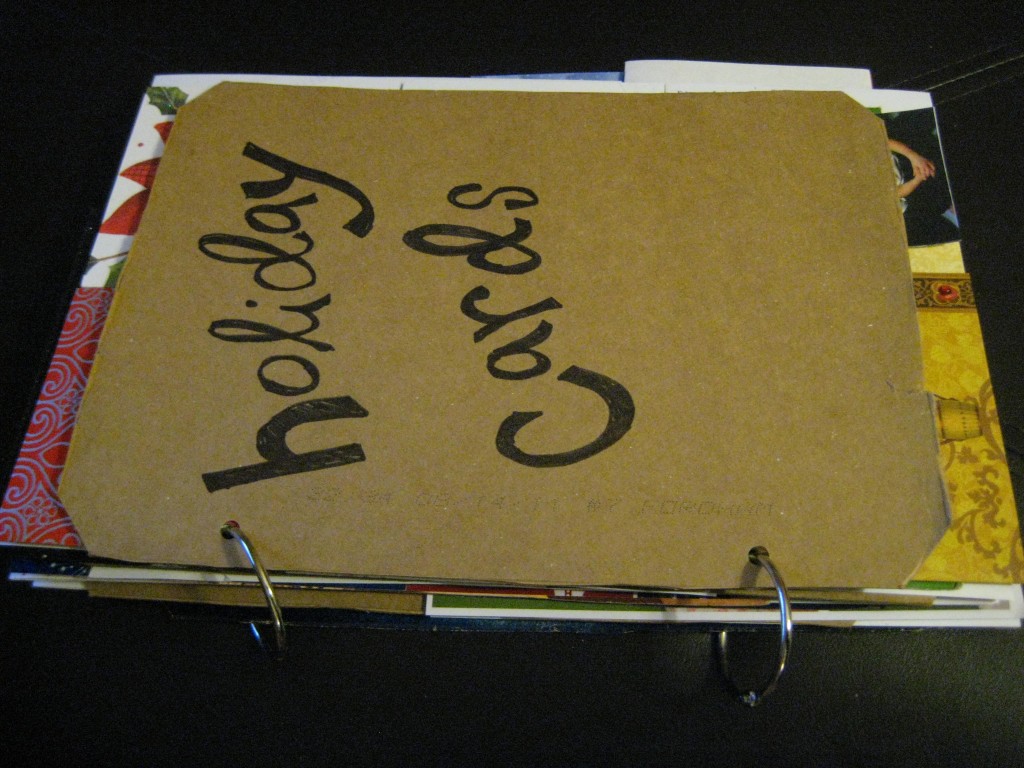

- Then: Do another fun craft project like this one:

holiday cards glued to (cereal box backs) pieces of cardboard and bound together to keep in order and look at - First: Try to decipher the world of investments and stocks. I’m told its high time I invested some of my pittance savings in order to avoid working until I”m 90 (should I be lucky enough to live that long…)

- Then: meet up with a friend I haven’t seen for WAY too long for drinks or coffee

- First: explore the world of creative/ writing position resumes for an internship I am looking into

- Then: show off my story that was published in a magazine to the world! Print issues come out this week!

- First: take my poor (dropped on concrete) smartphone to the phone doctor to get its touch screen hopefully revamped

- Then: end the week with a fun bowling party!

...but hopefully I don't end up like this...

Do you invest any of your money? Do you avoid paying confusing bills? What do you “have to do” or “get to do” this week?

Wish me luck!

Meri

42 Responses to Part time grown-up