It was a lovely weekend, which must mean…

yep, its Monday again. I made a pact with man-go-round yesterday, though. Instead of the usual “countdown to friday” that tends to seep into my subconscious increasingly until that sweet TGIF moment, we decided to embrace every day for the wonderful things in it, not wishing away a single awful Monday or Wednesday moment. (Well, maybe a moment, but not MANY moments…)

So, for this week’s list, I’ve decided to provide a fun reward for every “big girl task” I complete. As many things to look forward to as to cross off.

Now that I’m 27 its time to grow up list:

- First: face the music and pay off every last hospital bill from last fall

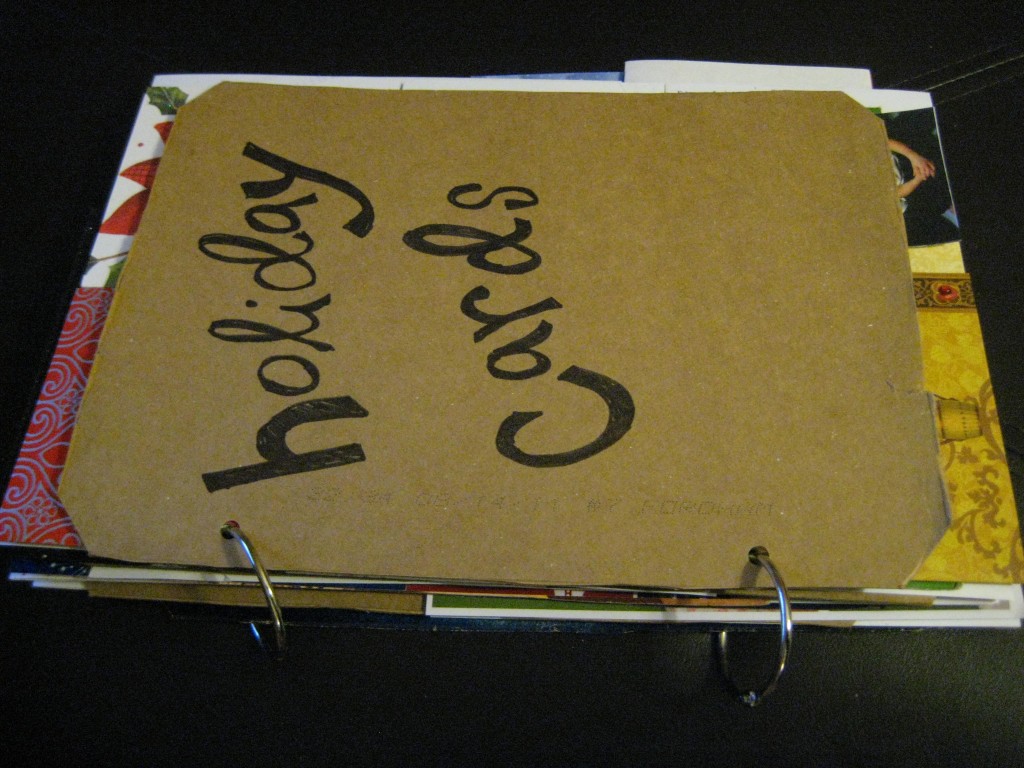

- Then: Do another fun craft project like this one:

holiday cards glued to (cereal box backs) pieces of cardboard and bound together to keep in order and look at - First: Try to decipher the world of investments and stocks. I’m told its high time I invested some of my pittance savings in order to avoid working until I”m 90 (should I be lucky enough to live that long…)

- Then: meet up with a friend I haven’t seen for WAY too long for drinks or coffee

- First: explore the world of creative/ writing position resumes for an internship I am looking into

- Then: show off my story that was published in a magazine to the world! Print issues come out this week!

- First: take my poor (dropped on concrete) smartphone to the phone doctor to get its touch screen hopefully revamped

- Then: end the week with a fun bowling party!

...but hopefully I don't end up like this...

Do you invest any of your money? Do you avoid paying confusing bills? What do you “have to do” or “get to do” this week?

Wish me luck!

Meri

Love this post! It speaks to me. I am always trying to balance the “big girl” tasks with the fun ones. Obviously I am still in the midst of rainbow week, which is going to enter its second week tomorrow to help me get through Eric being gone. I think caring for a child all on your own is in the “big girl” category so I am going to say those even out. Also, this weekend I had to finally get around to changing some light bulbs and cleaning the upstairs bathroom which I loathe doing.

I LOVE LOVE your holiday card book you made. Such a wonderful idea. I hope you will put in up on pinterest!

I heard about your week of “single parenting” haha. I’m pretty filled up with stuff all week, but don’t hesitate to call me if you need something! I put the book on pinterest, and a photo of garland I made for a party you missed from being sick 🙁 so you can see it now! its the paint strip garland.

Investing seems like a very scary and confusing world, but I wish you luck in your ventures! This week I’m looking for jobs and hoping to move into somewhat grown-up world. Let me know if your around or I’ll let you know if I happen back down to the metroplex. Hope you had a wonderful holiday season (your birthday, christmas, new year, etc.) What were you published in? That’s super awesome and a goal of mine for the near future.

I’ll send an e-mail to the magazine, the story is available free online already, its just the print issue I’m waiting for :0 I wish you luck in the job search- what kinds of jobs are you looking for? I should ask my sister if she has any ideas, she is living there again (Katie). I will let you know next time I’m home, or would love to meet up if you’re here!

*an e-mail “about” the magazine, not “to” the magazine…

King Pin! I have. 401k, and a couple of investment accounts.

Did you meet with a banker person or figure it out on your own?

I’ve always picked my own mix. I have a business degree though, so I took some finance in school.

that would surely come in handy! my psych degree doesn’t get me very far with my finances, or a lot of practical things…

It’s embarrassing, but since I’m in college, the only bills I really have are my tuition and the utility bills for my apartment and I don’t really pay either one. Dad takes care of tuition and the utilities are in my roommate’s name so I just hand her some money once a month. I really dread when I have to take care of stuff on my own in a few short months because I think I’m going to be pretty overwhelmed. :/ At least you have man-go-round!

Our bills are fairly manageable for the most part, I just don’t like trying to figure out matching up medical bills with statements from insurance, calculating copays, etc. Its a headache and I want to just forget it ever happened!

I love that you reward yourself for grown up tasks! Genius!!

haha, it sure makes me do the “grown up” stuff when I am motivated to do a big useless craft project 🙂

First, how can I get my hands on a copy of the magazine that published your story? Yes, I have some modest investments, the 403b through my workplace and some rental property. it is a good idea to get started young.

I wish I knew a good way to use real estate as an investment, but it just scares me terribly!

Aww. Do we have to grow up? 😉

That last picture made me laugh. I haven’t been bowling in forever! I think I want to treat myself to a family bowling night soon. 🙂

That movie is so freaking funny, I need to watch it again!

Congrats on being published – new chapter – awesome!

We’ve recently learned that financial advisers are not just for people with lots of money to decide what to do with. Not the kind that simply advise you which account or fund to put your money in – the kind (that I just found) that help you see where it’s going and how to be aware of where you’re overspending (without knowing it on things like bad mobile plans, wrong insurance plan, etc.) so that you can powerfully choose where it goes. A female adviser specializing in female clients is a very powerful thing. Women rock!

Also, tackling clutter and letting go of stuff.

Honestly, there’s not much I HAVE to do – I choose to do the things that I do.

Part of me wants to have a grand master plan, and part of me just wants to say, “hi, I want a few low risk investments” and then have someone choose them for me and let it sit there for a long time. I wish I were more motivated/ interested in it, but beyond trying to not just have my savings collect dust, its not motivating for me 🙁

Being pregnant my daily tasks are more health related these days. How to avoid heartburn today w/o having to take tums. 🙂 Preparing healthy meals the night before, so that I don’t eat junk food during the day. I had to start thinking about a servings of veggies, fruit, dairy, meat, etc. I used to act like I followed a healthy food diet before I became pregnant, but really I was just a poser. 🙂

Beside that, I have to admit I’m one of those COUNT DOWN to the weekend type gals. 🙂 I love to spend time with my hubby WORK FREE and just do nothing. Life is gonna get pretty crazy for us in the next couple of months with the wee one joining us, so I’m gonna catch up on as much sleep as possible. 🙂 Now try to get back to bed. Blast this wretchid pregnant insomnia!!! hehehee: )

you poor dear- go take a nap, then have daisy trained to bring you chocolates on the hour hahaha

My first attempt at being a “grown-up” was trying to get rid of ‘college clothes’ and invest in more ‘grown-up’ attire.

I still want to wear jeans and sweats all the time, though.

Even at 27 I want to be a kid!!!

[And I realize that had nothing to do with money talk. I need an IRA, but goodness knows I don’t have a clue how to get one.]

PS- Congrats on getting published!!!

Thanks- I’m so excited! I still wear totally immature clothes most of the time, its pathetic. My (teenage boy) body type doesn’t always allow for the most “sophistocated” of clothes haha

GREAT List!

I’m a list maker too. Gives me a reminder of what I need to do.

I HATE medical bills…….suck suck suck!

Have a Awesome Week…….and lots of fun bowling!

thanks- I’m a pitiful bowler but I like to drink pitchers of beer haha

Which magazine are you being published in?? Can’t wait to read it!

I do invest my savings…right now some of it is in a money market, which is earning approximately almost nothing (thanks economy), and the rest is in stock in my former employer, which is earning more than nothing. I also have a Roth IRA.

That being said I know absolutely nothing about how to play the stock market. My criteria for picking a money market was “hey, that doesn’t sound too risky,” and with my former employer it was “hey, I used to work there and it was fun.”

That’s interesting to invest in a former employer. Mine is a non-profit, so that doesn’t work 🙂 I think a Roth IRA sounds like a pretty good idea though. Thanks for your input!

I started a Roth IRA last year invested through Putnam so I don’t have to worry exactly what I want to be invested in. I really do feel better having some money tucked away for the long haul. Sure it has some risk involved and I’ve definitely watched the fund go up and down last year, but commonsense dictates that you *will* make money on it as long as you don’t touch it. I keep my emergency fund in a monkey market account where it gains an absolutely pithy amount of interest but is very accessible in case of, well, an emergency. Good luck with grown-up stuff! NPR’s Marketplace Money is a great place to start researching money and investment stuff!

Thanks for the (NPR) tip and for sharing your own experience. I don’t like the “idea” of not being able to get at my savings right away, but I also don’t like the idea of it collecting dust but not interest in a savings account that I know I won’t use anyway (because I am a money hoarder when I actually get any extra).

I love this post. I have some investments in gold and silver but one of my goals this year is to familiarize how stocks work. My grandpa was the VP of a huge bank and he died before he could teach me all the tricks to making my money work for me!

I’m excited to see your published story!!!

I like that idea, gold and silver… they never go out of style 🙂

Paying bills is the worst part of being a grown up!

agreed- its not even the money, its trying to sort through them all to figure it out! Argh!

Awesome list! I used to struggle with “big girl” stuff and the more “childlike” things. Then, I finally just let it all go. I think it’s the blend of adult and childlike things about ourselves that make us unique and keep us young. I just don’t want to be shopping at Forever 21 when I’m 60… I hope that is never me. LOL

haha- I am already frustrated with F21 sometimes. But I keep going back for the prices 🙂

Okay, I love this list and I am going to steal a few of your big girl tasks. I’m going to start with learning about the world of investments and stocks. I know next to nothing about the whole subject and once I’m settled into a career, I know the info will come in handy.

In my head, I’m really ambitious about this, but in reality it will probably take another few months at least.

Haha isn’t it always that way? It is for me. 😉

lovely ideas for week, I’ll definitely ‘steal’ some of them for me

I’d love to hear about it!

I’m awful about getting things done (as you probably know!). I’m a huge procrastinator. This week, I get to spend waaaaay too much time on the computer. ANd I have to write a book review for tomorrow.

Good luck getting it done! Which book?